The Total Cost Of Risk (TCOR) in times of Data Science

Written by: José Bernardo de Medeiros - 04/02/2020

It is not new to estimate the annual retention of financial losses resulting from the materialization of insurable risks to prepare a company’s budget.

This practice took shape in the first decade of the 21st century, more readily seen in businesses in the Northern Hemisphere which were equipped with teams managing corporate risks.

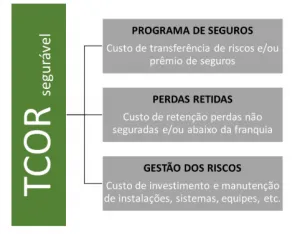

In summary, the total annual cost of insurable risks can be defined to be composed according to the elements in the diagram below:

In Latin America, this practice, applied in an organized and systematic manner, is still considered ‘innovative’. This is due to the lack of development of teams responsible for the integrated management of corporate risks and insurance as well as rudimentary cultural practices in data collection, management, modeling, and use.

In the past decade we have lived the advent and exponential expansion of the application of Data Science to solve business issues – until recently without the mere possibility of an answer. This new reality ’changed the game’ in a radical way, allowing the massive use of data to build predictive models that evolve over time, through Artificial Intelligence (AI) and Machine Learning.

Models of this nature are revolutionizing the possibilities of predicting the total costs of risks retained by companies, enabling more assertive decisions to be taken when contracting insurance and other risk transfer tools.

Here at Horiens, we are taking important steps in the use of Data Science for business, joining forces with specialists on specific risks from different market segments and our Risk Labs® Data Science specialists. With each new project delivered, we reinforce our belief in this powerful business tool.

One of our recent team achievements came about with the support of a mass transport services concession, which needed to understand its real risk exposure to third-party damages (GL – General Liability).

In a short time, Risk Labs collected 10 years’ worth of data, managed and modeled the behavior of the company’s performance in lawsuits. The result was a highly adherent model, capable of predicting and quantifying the company’s liabilities, adjusted for risk.

Through this study, the concession top management team designed a TCOR strategy based on the performance of its ‘GL Portfolio’. The TCOR solution was achieved by integrating the available risk transfer tool (insurance policy), with the financial contingency adjusted to the risk (to respond to the retained risks), with an appropriate investment plan (improvements in facilities and systems, team training, among others).

Therefore, we continue to use this powerful tool to support our clients to look further ahead.